Understanding Gold as a Safe Haven Investment

Sarah Iminski

Senior Investment Analyst

Gold has been valued for thousands of years, not just for its beauty but for its unique properties as a store of value. In modern investment portfolios, gold continues to play a crucial role, especially during times of economic uncertainty.

Why Gold Remains Relevant

Unlike paper currencies, gold cannot be printed at will by governments. Its supply increases only by about 1.5% per year through mining, creating inherent scarcity that helps maintain its value over time.

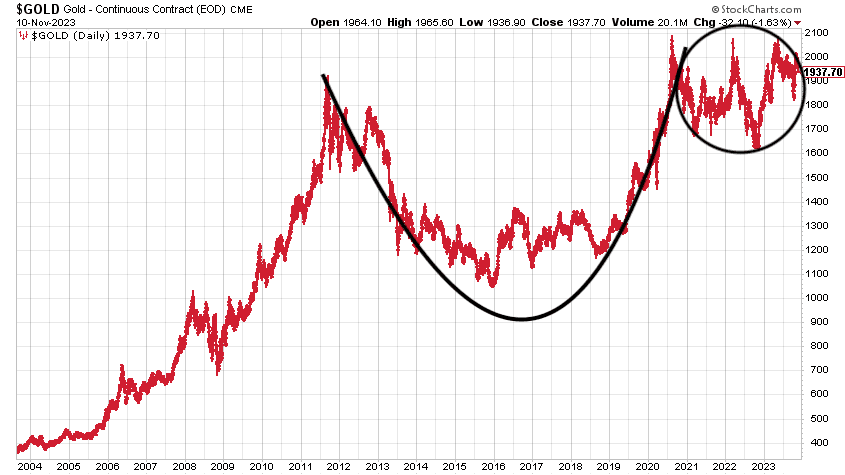

During the 2008 financial crisis, gold prices increased by over 25% while many other asset classes experienced significant declines. This pattern has repeated throughout history, demonstrating gold's negative correlation with traditional markets during periods of stress.

Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now.

Portfolio Allocation Strategies

Most financial advisors recommend allocating between 5-15% of a portfolio to gold, depending on your risk tolerance and economic outlook. This allocation can help reduce overall portfolio volatility while providing protection against inflation and currency devaluation.

- Physical gold (coins and bars)

- Gold ETFs and mutual funds

- Gold mining stocks

- Gold futures and options

Each method of gold investment carries different advantages and risks. Physical gold offers direct ownership but requires secure storage, while paper gold investments like ETFs provide convenience but introduce counterparty risk.

Conclusion

While gold should not be the only component of your investment strategy, its historical performance during economic crises makes it a valuable diversification tool. Understanding how and when to incorporate gold into your portfolio can help protect your wealth during uncertain times.

Share this article

About the author

Sarah has over 15 years of experience in precious metals investing and market analysis.